MBA students majoring in Quantitative Finance will have both the technical expertise that allows them to compete for quantitative positions in finance, and the generalist MBA experience that provides them with the necessary leadership skills to quickly rise to the top of their organizations We provide the following dissertation services: Degree dissertations, Masters Dissertations, PhD dissertations, Dissertation Editing and proofreading. Our dissertation writers have remarkable experience in academic writing and they always produce A+ dissertation blogger.com you want our dissertation writing help, it is very simple Nov 02, · MBA Finance Course is a 2 year postgraduate program pursued by students aspiring to build a career in financial management. Currently, MBA Finance Admissions are ongoing in top MBA Colleges in India. Admission to the MBA Finance course is based on national or state level entrance exams such as CAT, MAT, XAT, SNAP and alike. MBA Finance Latest

Best Dissertation Writing Services. Top-Ranked by Students!

The Quantitative Finance major aims to prepare students for a wide range of careers in the financial industry, including quantitative asset management and trading, financial engineering, risk management and applied research. The major places a strong emphasis on financial economics and data analysis, in addition to advanced quantitative and computational methods.

It is designed to appeal to students with strong quantitative backgrounds who wish to develop their skills for quantitative applications in finance. Although based in the Finance Department, the major will also include relevant cross-disciplinary content from accounting, statistics and operations, information and decisions. Some doctoral courses in Finance may also be counted towards this major.

MBA students majoring in Quantitative Finance will have both the technical expertise that allows them to compete dissertation in mba finance quantitative positions in finance, and the generalist MBA experience that provides them with the necessary leadership skills to quickly rise to the top of their organizations. Why Choose Quantitative Finance? Industry Advisory Panel. All students must take or replace FNCE and FNCE Students with a strong background in Finance may apply to replace FNCE with any upper-level finance course to fulfill their core corporate finance requirement.

Qualified students with a strong economics dissertation in mba finance may apply to replace FNCE with either FNCEInternational Financial Markets and Cryptocurrencies, FNCEInternational Banking or FNCE Central Banks, Macroeconomic Policy and Financial Markets, to fulfill their core macroeconomics requirement.

Independent Study Project FNCE and Global Modular Courses cannot be used to fulfill core requirements. To complete the major, students must take an additional four credit units of dissertation in mba finance Finance electives.

Dissertation in mba finance least 3 c. The remaining 1 c. This major cannot be taken in conjunction with the general FNCE major. Moreover, dissertation in mba finance, ACCTdissertation in mba finance, OIDDSTAT and STAT count only for the Quantitative Finance major and will not be count as part of the 4 c. requirement for the general Finance major. Formerly FNCE This course studies the concepts and evidence relevant to the management of investment portfolios.

Topics include diversification, asset allocation, portfolio optimization, factor models, the relation between risk and return, trading, dissertation in mba finance, passive e. The course deals very little with individual security valuation and discretionary investing i. This course covers one of the most exciting and fundamental areas in finance.

Financial derivatives serve as building blocks to understand broad classes of financial problems, such as complex asset portfolios, strategic corporate decisions, and stages in venture capital investing.

The main objective of this course is build intuition and skills on 1 pricing and hedging of derivative securities, and 2 using them for investment and risk management.

In terms of methodologies, we apply the non-arbitrage principle and the law of one price to dynamic models through three different approaches: the binomial tree model, the Black-Scholes-Merton option pricing model, and the simulation-based risk neutral pricing approach. The course covers a wide range of applications, including the use of derivatives in asset management, the valuation of corporate securities such as stocks and corporate bonds with embedded options, interest rate and credit derivatives, as well as crude dissertation in mba finance derivatives.

We emphasize practical considerations of implementing strategies using derivatives as tools, especially when no-arbitrage conditions do not hold. Major topics in this class include foreign exchange rates, international money markets, currency and interest rate derivatives forwards, options, and swapsinternational stock and bond portfolios, and cryptocurrencies. Students learn about the features of financial instruments and the motivations of market participants.

The class focuses on risk management, investing, and arbitrage relations in these markets. This course covers fixed income securities including fixed income derivatives and provides an introduction to the markets in which they are traded, as well as to the tools that dissertation in mba finance used to value these securities and to assess and manage their risk.

Quantitative models play a key role in the valuation and risk management of these securities. As a result, although every effort will be made to introduce the various pricing models and techniques as intuitively as possible and dissertation in mba finance technical requirements are limited to basic calculus and statistics, the class is by its nature quantitative and will require a steady amount of work.

In addition, some computer proficiency will be required for the assignments, although familiarity with a spreadsheet program such as Microsoft Excel will suffice. This course will introduce students to data science for financial applications using the Python programming language and its ecosystem of packages e. To do so, students will investigate a variety of empirical questions from different areas within finance including: FinTech, investment management, corporate finance, corporate governance, venture capital, private equity, and entrepreneurial finance.

The course will highlight how big data and data analytics shape the way finance is practiced. The course objective is twofold: 1 illustrate how data analytics can improve financial decision-making, and 2 provide students with a foundation for performing data analytics in finance-related roles both inside the financial sector e.

There is an abundance of evidence suggesting that the standard economic paradigm — rational agents in an efficient market — does not adequately describe behavior in financial markets. In this course, we will survey the evidence and use psychology to guide alternative theories of financial markets.

Along the way, we dissertation in mba finance address the standard argument that smart, profit-seeing agents can correct any distortions caused by irrational investors. Further, we will examine more closely the preferences and trading decisions of individual dissertation in mba finance. We will argue that their systematic biases can aggregate into observed market inefficiencies, thus giving rise to apparently profitable trading strategies. The latter part of the course extends the analysis to corporate decision making.

We then explore the evidence for both views in the context of capital structure, investment, dividend, and merger decisions. In addition to prerequisites, dissertation in mba finance, FNCE is highly recommended but not required.

This course will cover methods and topics that form the foundations of modern asset pricing. These include: investment decisions under uncertainty, mean-variance theory, capital market equilibrium, arbitrage pricing theory, state prices, dynamic programming, and risk-neutral valuation as applied to option prices and fixed-income securities.

This class covers advanced pricing models for equity, fixed income and credit derivatives. It aims at: 1 Introducing the main models used in practical applications to price and hedge derivatives; 2 Understanding their comparative advantages and limitations, as well as how they are calibrated and applied. As part of team assignments, students will be asked to calibrate and implement the models introduced in the class using software of their choice.

This is a Doctoral level course. It provides students with an introduction to the frontier empirical methods commonly employed in finance research. The course is organized around empirical papers with an emphasis on econometric methods. A heavy reliance will be placed on analysis of financial data. This course focuses on the dissertation in mba finance of financial communications between corporate managers and outsiders, including the required financial statements, voluntary disclosures, and interactions with investors, analysts, and the media.

The course draws on the findings of recent academic research to discuss a number of techniques that outsiders can use to detect potential bias or aggressiveness in financial reporting. FORMAT: Case discussions and lectures. Comprehensive final exam, group project, case write-ups, and class participation. Quantitative methods have become fundamental tools in the analysis and planning of financial operations. There are many reasons for this development: the emergence of a whole range of new complex financial instruments, innovations in securitization, dissertation in mba finance, the increased globalization of the financial markets, the proliferation of information technology and the rise of high-frequency traders, dissertation in mba finance, etc.

In this course, models for hedging, asset allocation, and multi-period portfolio planning are developed, implemented, and tested. In addition, pricing models for options, bonds, mortgage-backed securities, and other derivatives are studied. This course is quantitative and will require extensive computer use.

The course is intended for students who have strong interest in finance. The objective is to provide students the necessary practical tools they will require should they choose to join the financial dissertation in mba finance industry, particularly in roles such as: derivatives, quantitative trading, dissertation in mba finance, portfolio management, structuring, financial engineering, risk management, etc.

An introduction to Stochastic Processes. The primary focus is on Markov Chains, dissertation in mba finance, Martingales and Gaussian Processes. We will discuss many interesting applications from physics to economics. Topics may include: simulations of path functions, game theory and linear programming, stochastic optimization, Brownian Motion and Black-Scholes. This dissertation in mba finance provides an introduction to the wide range of techniques available for statistical forecasting.

Qualitative techniques, smoothing and decomposition of time series, dissertation in mba finance, regression, adaptive methods, autoregressive-moving average modeling, and ARCH and GARCH formulations will be surveyed. The emphasis will be on applications, rather than technical foundations and derivations. The techniques will be studied critically, with examination of their usefulness and limitations. Stacy Franks — stacyf wharton. Professor Nikolai Roussanov — nroussan wharton.

Skip to content Skip to main menu. FINANCE ELECTIVES To complete the major, students must take an additional four credit units of upper-level Finance electives. FNCE — Financial Derivatives This course covers one of the most exciting and fundamental areas in finance. FNCE — International Financial Markets and Cryptocurrencies Major topics in this class include foreign exchange rates, international money markets, currency and interest rate derivatives forwards, options, and swapsinternational stock and bond portfolios, and cryptocurrencies.

FNCE — Fixed Income Securities This course covers fixed income securities including fixed income derivatives and provides an introduction to the markets in which they are traded, as well as to the tools that are used to value these securities and to assess and manage their risk. FNCE — Data Science for Finance This course will introduce students to data science for financial applications using the Python programming language and its ecosystem of packages e. FNCE — Behavioral Finance There is an abundance of evidence suggesting that the standard economic paradigm — rational agents in an efficient market — does not adequately describe behavior in financial markets.

FNCE — Foundations of Asset Pricing This course will cover methods and topics that form the foundations of modern asset pricing. FNCE — Financial Engineering This class covers advanced pricing models for equity, fixed income and credit derivatives.

FNCE — Introduction to Empirical Methods in Finance This is a Doctoral level course. ACCT — Financial Disclosure Analytics This course focuses on the analysis of financial communications between corporate managers and outsiders, including the required financial statements, voluntary disclosures, and interactions with investors, analysts, and the media. OIDD — Mathematical Modeling and its Application in Finance Quantitative methods have become fundamental tools in the analysis and planning of financial operations.

STAT — Stochastic Processes An introduction to Stochastic Processes. STAT — Forecasting Methods This course provides an introduction to the wide range of techniques available for statistical forecasting. edu FACULTY ADVISOR: Curriculum Professor Nikolai Roussanov — nroussan wharton.

Warren Buffett: Why I HATE MBA?

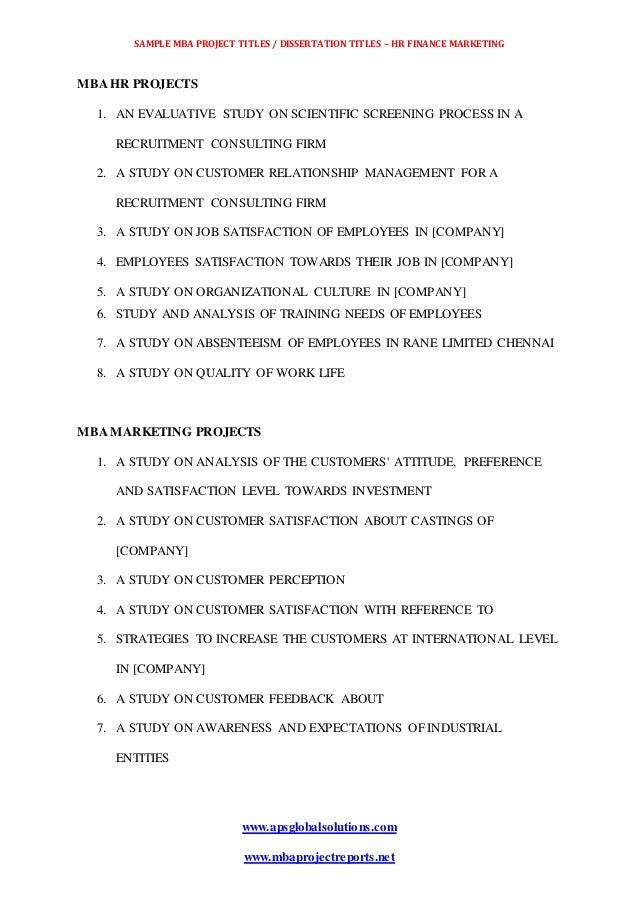

, time: 8:58Finance Dissertation Topics: Useful List To Inspire You

Nov 02, · MBA Finance Course is a 2 year postgraduate program pursued by students aspiring to build a career in financial management. Currently, MBA Finance Admissions are ongoing in top MBA Colleges in India. Admission to the MBA Finance course is based on national or state level entrance exams such as CAT, MAT, XAT, SNAP and alike. MBA Finance Latest Why is a Rice MBA worth the investment? Watch our finance professor James Weston calculate the ROI of an MBA from Rice Business to help you make your decision. You may also qualify as one of the 87% of full-time students who earn a scholarship or grant Mar 20, · Selecting a good fashion dissertation topic plays a crucial role. If the topic of your choice does not have enough resources and ideas, you are in great trouble. So discuss a topic about which you have passion and an important part of an academic part of the view

No comments:

Post a Comment